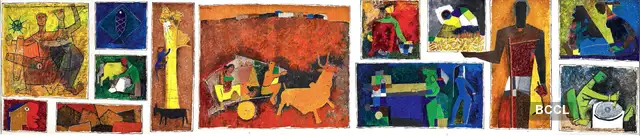

Gram Yatra by M.F. Husain was sold at a Christie’s auction in New York in March, for US$13.8 million (Rs.119.1 crore), the highest-ever by an Indian artist.

They soon acquired a third painting, Horses, by M.F. Husain. “Husain was famous for his horses,” says Rajgopal, remembering how fascinated he was when he first saw it. He first read about the Raza painting in a book picked up during their first visit to an art auction around 2000. What began as curiosity soon grew into a deeper study, and eventually, a yearning to own a tangible piece of India’s artistic heritage.

Rajgopal, a retired Unilever executive, and his wife, a retired surgeon, built their collection out of curiosity, not as an investment strategy. Yet the financial returns have been remarkable. The Raza landscape has appreciated nearly thirtyfold in just over two decades. The Souza and Husain artworks have also appreciated significantly. “They are akin to blue-chip stocks in equity markets,” says Rajgopal.

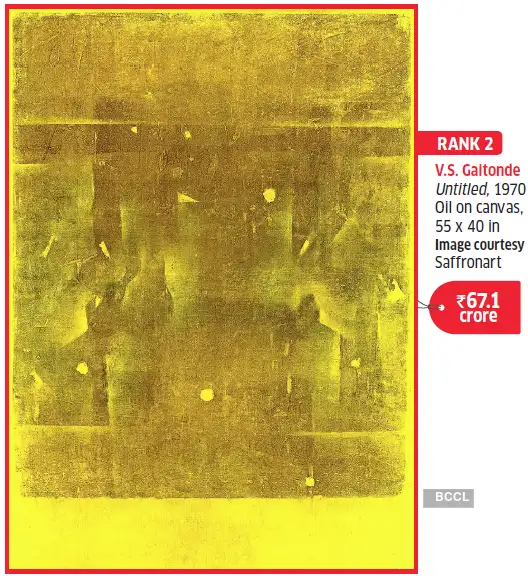

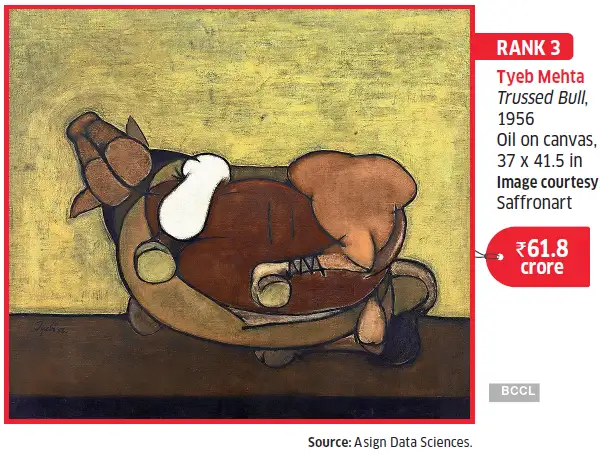

Some of the art auctions held so far in 2025 have broken records. Four paintings, one each by Husain, Souza, V.S. Gaitonde and Tyeb Mehta, became the most expensive works by Indian artists ever sold globally.

The cost of buying art

Hammer price

+ GST (5%) + Buyer’s premium + GST on buyer’s premium (5%)

+ Packing & transportation

+ Insurance (0.2-0.5% of the art value)

How art insurance works

Premium

0.2-0.5% of art value

Policy tenure

1 year (to be renewed every year)

Sum assured

The value of your artwork

What’s covered

- All accidental physical loss and damage

- Fire, earthquake, storm, natural calamities

- Theft and burglary

What’s not

- Fungus

- Moisture

- War

- Terrorism (covered only if paid separately)

How do claims work?

Example: Rs.10 lakh artwork damaged

Restoration cost

Rs.25,000

After restoration worth Rs.9 lakh

Claims process 2 weeks, if documents are in order

Insurance pays

Rs.1 lakh (loss of value) + Rs.25,000 (restoration = Rs.1.25 lakh)

Biggest insurance mistakes

- Home insurance covered artworks

- Going for cheapest premium

- Not reading the policy document

These record-breaking works belong to what art historians call “Modern Indian Art”, a movement that flourished between the 1940s and the 1980s, led by artists like Husain (1913-2011), Raza (1922-2016), Souza (1924-2002), and Gaitonde (1924-2001). These are the “masters” or “modern artists” that dominate auction houses today. In contrast, “contemporary artists” refers to living artists working today, a different category with different price dynamics and risks.

What’s driving the boom

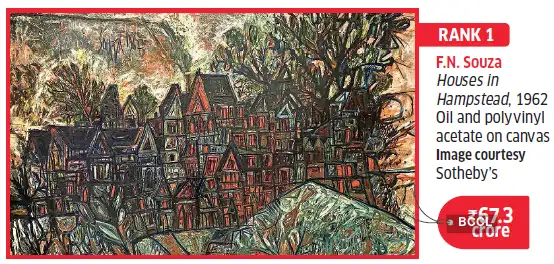

Indian auctions achieved their highest-ever half-yearly sales in the Financial Year 2026, surpassing full-year totals recorded until 2022, according to Asign Data Sciences, one of India’s leading art market data and intelligence companies. In March this year, Husain’s Gram Yatra painting got sold for US$13.8 million (Rs.119.1 crore) at a Christie’s auction in New York, the highest-ever by an Indian artist. Souza’s Houses of Hampstead fetched Rs.67.3 crore at a Sotheby’s auction in London in September, the second-highestgrossing painting ever, by an Indian artist. V.S. Gaitonde’s Untitled painting fetched Rs.67.1 crore at an auction at Saffronart (one of India’s leading auction houses), in its 25th anniversary Evening Sale in September. At its earlier 25th anniversary live and online sale, held over two days in April, Tyeb Mehta’s Trussed Bull fetched Rs.61.8 crore. Both of Saffronart’s April auctions were sold at 100%. In the live sale, 80% of the items sold above their higher estimates, and in the online sale, 75% of the items sold over their higher estimates.

Dinesh Vazirani, Co-Founder and Chief Executive Officer of Saffronart, observes that after the brief lull following the 2008 Lehman crisis, which interrupted the art boom that began around 1999-2000, momentum in the art world has returned in the post-pandemic years. “After Covid-19, people found themselves confined to homes and began to rethink their surroundings,” says Vazirani, who, along with his wife Minal, founded Saffronart in 2000. “Home became central to our lives. As people spent more time indoors, they started paying attention to their walls, to the art they lived with, or even to the absence of it. Many began exploring ways to bring art into their spaces, while others rediscovered and appreciated works they already owned.”

The art buyer is also getting younger. “Around 15-30% of art buyers are new. About six-seven years ago, the average age of an art buyer used to be 40-45, now it has got younger,” says Manjari Sihare-Sutin, Vice President, Co-Worldwide Head, Indian and South Asian Art, Sotheby’s. Wealth managers catering to high-net-worth individuals (HNIs) and ultra-HNIs are witnessing a growing inclination among clients to diversify beyond traditional asset classes such as equities, debt, gold, and international markets.

“There is also a lot of new wealth that is created in the economy. We’ve seen many technology startup promoters and founders becoming soonicorns and unicorns. Many promoters who have been running businesses across India for the last two-three generations have gone for public or private dilution. They’ve stumbled upon significant financial wealth and are now running family offices. The next generation club want to buy art,” says Amit Saxena, Managing Director, Nuvama Private, one of India’s largest wealth management firms that focuses on UHNIs. This explains the surge in new buyers in the art world.

The third edition of Art Mumbai is expected to draw even more visitors, if Vazirani is to be believed. Co-founded by leading art figures—Minal and Dinesh Vazirani, Conor Macklin of Grosvenor Gallery, London, and Nakul Dev Chawla, Director of Chawla Art Gallery, New Delhi—Art Mumbai will be held at the Mahalakshmi Race Course from November 13 to 16. The fair will feature artworks from 82 galleries across India and abroad. Vazirani expects “a marked increase” in visitors this year, up from 24,000 last year.

The hidden costs

Before you rush into an auction house or an art gallery, or even to the art event in Mumbai, here’s what you should know.

First, the cost you pay at an auction house—good art rarely comes cheap—isn’t your only expense. Over the hammer price (the artwork’s sale price), you must also pay a buyer’s premium—the commission charged by the auction house acting as an intermediary between the seller and buyer—typically 20-25%. In addition, a 5% Goods and Services Tax (GST), reduced from 12% in September, is levied on both the hammer price and the buyer’s premium.

What does this look like in practice? For an artwork with a Rs.30 lakh hammer price, the final bill can easily climb past Rs.42 lakh, once you factor in the 25% buyer’s premium (Rs.7.5 lakh), 5% GST on the total, and essential charges for shipping, insurance, and storage.

Galleries don’t charge a buyer’s premium; instead, they take a share of the artist’s sales, typically 0- 50%. While galleries represent living artists in the primary market, auction houses deal in the resale of existing works in the secondary market. If you are importing artwork, expect to pay a customs duty of around 10%.

Next, you need to arrange for the work to be transported. Local transportation is negligible; however, if you need to ship the painting abroad, the charges, including documentation, outward customs clearances and air freight, can cost about `1- 2.5 lakh. Jeroo Buhariwala, Director at Buhariwala Corporation, a renowned packing and moving company, states that this accounts for roughly 75% of the cost of delivering the painting from the airport to the destination and having it unpacked abroad.

If you need to store the painting, make sure the storage facility is equipped to handle expensive artwork. Buhariwala explains that storage spaces require RCC construction (not tin roofs), climate control, dedicated racks, and continuous dehumidification. Special wooden cases that let paintings “breathe” cost Rs.2,500-20,000 depending on the size. “You should not store a painting inside a case while it is kept in a climatecontrolled warehouse, that’s hazardous,” says Buhariwala.

Make sure to insure your paintings, as you would any other valuable item. These policies are typically one-year indemnity contracts and require annual renewals. Premiums are calculated based on the artwork’s insured value. Depending on the size and nature of the collection, the premium typically ranges from 0.2% to 0.5% of the total art value. Only a few insurers are offering exclusive art insurance policies.

Specialised brokers like Unilight Insurance, used by major galleries and auction houses, can access international reinsurance terms to customise policies beyond standard domestic offerings, and that’s beneficial for rare or high-value artworks.

How much cover should you buy?Ideally, it should be equivalent to the total cost of the artwork—the hammer price (the sale price), plus the buyer’s premium, and the GST on both. If you already own the artwork, consult an art adviser to assess its current market value and purchase insurance for that amount. Art consultants typically charge around Rs.3,000-Rs.6,000 per artwork to value your art. For an extensive collection, they generally work on a lump sum fee or an annual maintenance contract, which you will bear, not the insurer.

Highest selling lots of H1FY2026

What’s covered? All accidental physical losses and damages are covered, regardless of cause, including fire, earthquakes, natural disasters, theft, and burglary. Accidental damage, such as your painting falling off the wall, etc, is also covered. What is not covered? If your artwork is damaged by atmospheric conditions such as fungus or moisture, your insurer won’t cover it. Loss due to war is not covered. Even terrorism is not covered unless you buy an add-on cover.

How does the claim work? In the event of partial loss, your insurer will pay you the restoration cost, plus the difference in value if your artwork’s value decreases as a result of the damage. Say, your artwork worth Rs.5 lakh gets damaged. You spend Rs.25,000 on restoration, but after repairs, its value drops to Rs.4 lakh. Your insurer will then pay rs.1.25 lakh — covering both the restoration cost and the loss in value. In the event of a total loss, the agreed value is paid. Puneet Goel, Senior Vice-President of Unilight Insurance Brokers, states that if the documents are in order, your claim can be settled within approximately two weeks. Aside from regular documents like an incident report (similar to a claims form of a regular insurance policy), you also need a “loss of value” certificate.

“Make sure your artwork is professionally packed if you are moving it anywhere, or else your claim can be rejected,” says Goel.

Remember, your art insurance is separate from your home insurance policy. Since home insurance limits coverage to only `10,000 per artwork, unless specified, Goel recommends buying a standalone art policy. Make sure you read it carefully to understand what’s covered, what’s not. “Don’t buy a policy just because it comes with the lowest premium,” says Goel.

And that’s assuming what you bought is even authentic.

Note:“After Covid-19, as people spent more time indoors, they started paying attention to their walls, to the art they lived with, or even to the absence of it.”

DINESH VAZIRANI

Co-Founder and Chief Executive Officer, Saffronart

The fake problem

The art world, much like the financial world, is not immune to fraud and fakes. When artworks are worth lakhs and crores, and it takes years to build a good collection, you must verify what you buy. “Authenticity is a big issue because the art market is very illiquid,” says a Delhi-based art collector who spoke to ET Wealth on condition of anonymity.

Buy from reputed art galleries and auction houses. Mortimer Chatterjee, Founder of Chatterjee & Lal, one of India’s bestknown galleries, says that if you buy from a reputed gallery that represents an artist, your risks are reduced. If the artists are alive, there’s enough material to read about them, and the gallery sells it directly from them. The issue, he says, arises when you buy a painting by an artist who’s no longer alive, such as in a secondary market, at an art auction.

To avoid fakes, stick to reputable auction houses. “Always ask for an authenticity certificate, even for a young artist,” says Chatterjee. Typically, authenticity certificates are signed by the artists themselves. But if it’s an older artwork, Chatterjee explains, poor record-keeping in earlier times, and the fact that the artist is no longer alive, often mean there is no selfdeclaration certifying authenticity. In such cases, the artist’s estate may hold records or evidence to verify the artwork’s provenance. One could look up a museum that the artist’s family or legal heirs may be managing, or any legal entity holding the artist’s assets. Chatterjee says that even if you personally know an artist —presumably a young artist —you still need an authenticity certificate, because your legal heirs, say, 50-60 years down the line, would need it.

If that is not available, “look for the exhibition catalogues in which the work has appeared, any proof or source where we can trace the painting back to the original artist,” says Shivani Sambhare, a Mumbai-based art consultant.

A provenance certificate, on the other hand, is a documented history of ownership that traces the complete chain of custody from the artist to the current owner. It shows where the artwork has been since its creation, who has owned it over time, its exhibition history and its publication history (which books/catalogues have featured it). In fact, if your artwork has been displayed in a museum, its value goes up significantly. When the Kiran Nadar Museum borrowed Rajgopal’s Ghulam Mohammed Sheikh painting for an exhibition, its value increased overnight. Rajgopal says, “If you own good pieces and are connected with museums, galleries, art fairs, or biennales, I would encourage you to lend them, it enhances the provenance of your collection and increases the artwork’s value.” That’s also a tip to increase the value of your art portfolio and a way to find genuine artists, if you’re on the lookout.

The first timer’s playbook

Start with passion, not profit

Don’t come in for the money. Buy what you love. “Knowing what you don’t want is more important than knowing what you want,” says Sihare-Sutin of Sotheby’s. The biggest mistake? Buying based on someone else’s opinion instead of your own taste.

Focus your collection

Art collector Rajgopal advises focusing on 10-15 artists. When he first started, he picked up artworks from around the world— China, Brazil, Vietnam. But as his taste evolved, he realised he couldn’t buy what he truly loved because there wasn’t enough space to store everything. “I wish I had been more selective early on,” he says.

Do your homework

Visit museums and galleries. Read books. Attend art fairs. Study the artists whose work speaks to you. “The more you see, the better you understand,” says Rajgopal.

Budget for surprises

“If your estimate is Rs.30 lakh, be prepared for Rs.50 lakh plus 25% in extra costs,” says Rajgopal. Between buyer’s premiums, GST, insurance, shipping, and storage, the hammer price is just the beginning.

Play the long game

Art is a generational asset. Be prepared to hold for at least 10 years—and even then, finding the right buyer requires patience.

What if you still end up with a fake? Pallav Shukla, Partner- Artwork Advisory at law firm Trilegal, warns that proving fraud is difficult under Indian law. “To establish a successful case for cheating, it must be proven that the seller/gallery/auction house was aware that the artwork was fake and proceeded to offer it for sale anyway,” says Shukla. Your contract should include a clause allowing for refunds or legal remedies if the work is later found to be inauthentic. “For high-value purchases, insist on arbitration clauses rather than litigation, it’s confidential and faster,” he adds.

Given all these challenges, how long will it take to actually sell?

Buy what you love, art is a matter of heart

- Knowing what you don’t want is more important

- Focus on 15-20 artists, not 50

- Visit museums, galleries before your first buy

Biggest mistake

- Buying art based on someone else’s opinion

Liquidity: The 10-year wait (and counting)

The price you pay at an auction tells you how much you or others are willing to pay for that artwork. But how do you determine the return an artwork yields? Repeat auction sales show sustained demand. Jagdish Swaminathan’s Colour Geometry of Space (1966) sold for Rs.64.74 lakh at a Saffronart auction in 2023. It returned at yet another Saffronart auction in 2025 and was sold for Rs.1.14 crore translating to an impressive compound annual growth rate (CAGR) of 32.7% over a roughly two-year period. Bikash Bhattacharjee’s When She Was…! After Censor, 1978 was sold for Rs.9.3 lakh at an AstaGuru auction in 2023.

Note:“Always ask for an authenticity certificate, even for a young artist… It takes a buyer who equally appreciates the uniqueness to come up and bid for your artwork.”

MORTIMER CHATTERJEE

Founder, Chatterjee & Lal

It resurfaced again at another AstaGuru auction in July 2025 and was sold for Rs.19.3 lakh, representing a 36.5% compounded return.

However, all art experts agree that these are rare examples of artworks sold at such rapid intervals and yet fetching handsome prices. One reason is that these works are associated with older and senior artists. “You need patience. You need to wait for at least 10 years, unless it’s work that has been made in the 1970s or before period, in which case you stand a chance to earn a good return,” says Sambhare. Chatterjee says that art is subjective. “It takes a buyer who equally appreciates the uniqueness to come up and bid for the artwork,” says Chatterjee, adding, you have to be prepared to wait for months after you decide to put your artwork up for sale.

Artwork sold after 24 months is subject to a 12.5% long-term capital gains tax. If sold before 24 months, short-term capital gains are calculated under your standard tax slabs.

The reality check

Not all art appreciates

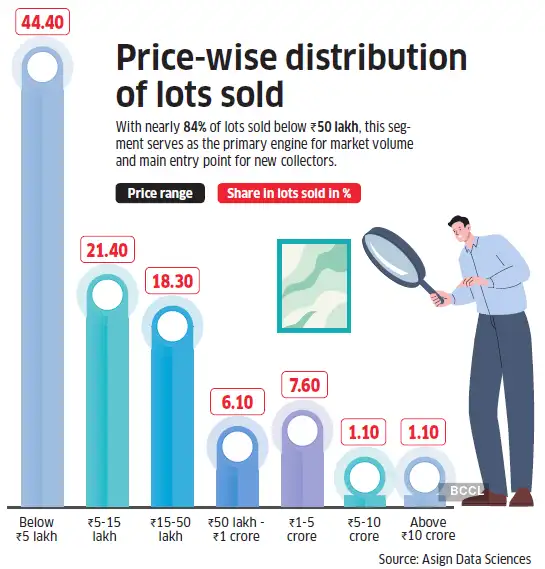

Data from Asign Data Sciences shows that the secondary market in the entry-level segment (artworks priced below Rs.5 lakh) is tough. A total of 973 lots were sold in the first half of FY 2026, down from 1,083 lots in the first half of FY 2025. This segment recorded a turnover of Rs.17.2 crore, down from Rs.18 crore in the same period last year, representing a 4.10% decline. The fact that first-time buyers typically target this segment shows that art requires patience. “Among the repeat sales lots that did sell at a loss, over half (54.2%) were by contemporary artists,” says Venetia Vickers, Chief Economist, Asign.

“That’s mainly due to limited collector bases, supply overhangs, and hype-driven price spikes that lack sustainable demand. Success requires selectivity, patience, and recognising that not all art appreciates. Liquidity is limited outside a small group of established artists,” she says.

On the other end are the top-end artists, called the masters or modern artists, whose works often sell for more than Rs.1 crore. In the first half of FY 2026, works that sold for over Rs.1 crore contributed to 83.3% of the lots sold and 91.6% of the turnover, as per Asign. The flipside? That’s very expensive, and not everyone’s cup of tea.

Thus, works of the masters are far more expensive than those of contemporary artists. “Asign’s data points to a distinct ‘sweet spot’ in the Rs.15-50 lakh range. This segment accounted for only 12.5% of the total unsold lots. Additionally, over 81% of lots from this price segment sold above the upper estimate, a clear sign of rising investor appetite,” says Vickers. This group, she adds, includes artworks by modern masters, senior living post-independence moderns, and established contemporaries, artists with proven market histories and strong resale visibility.

Thinking of pooling money into an art fund? Think again. Following the 2010 Osian’s Art Fund collapse, the Securities and Exchange Board of India (Sebi) now treats art funds as collective investment schemes. “Launching an art fund without Sebi registration is illegal and can lead to civil and criminal penalties,” says Shukla. For most investors, this means that art remains a direct, personal investment, rather than a mutual fund-style vehicle.