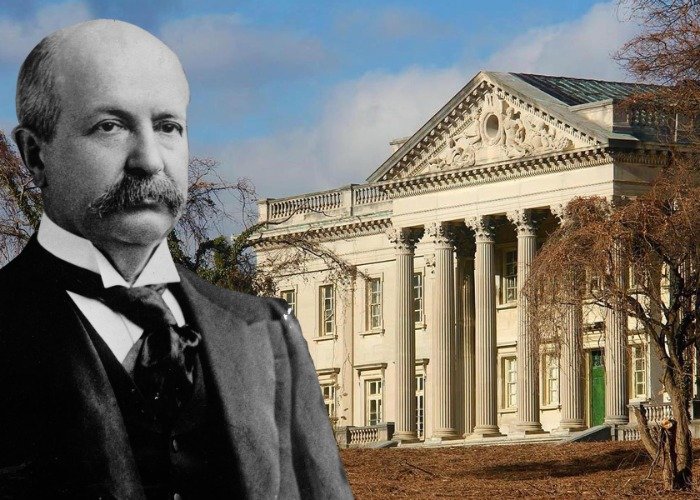

Lynnewood Hall: the abandoned mansion with a tragic Titanic connection

While the organisation has declined to disclose the price that Lynnewood Hall changed hands for, they revealed that they’d initially raised $9.5 million (£7.2m) to cover the purchase of the estate, urgent work and stabilisation efforts. Following an extensive restoration plan, which is projected to cost upwards of $90 million (£68m), the group intends to open the