The value of a Picasso or a Ferrari typically rises in a strong economy, as do shares in a consumer staple like Procter & Gamble.

But when the economy sours, those shares may be easier than the other possessions to shed. As wealthy collectors pull back on extravagances, investors could get stuck holding an asset they might have to unload at a loss.

In 2012, when the market was roaring for passion assets — those in which you put money where your heart is — I wrote a series of columns on why people invested in things like vineyards, racehorses and sports teams.

This time, I will look at five nontraditional asset classes that are popular with wealthy investors and with an eye on what to expect in a market downturn. Art is the first of five valuable but illiquid assets I plan to examine in the coming weeks. The others are cars, collectibles like wine and jewelry, private equity and real estate.

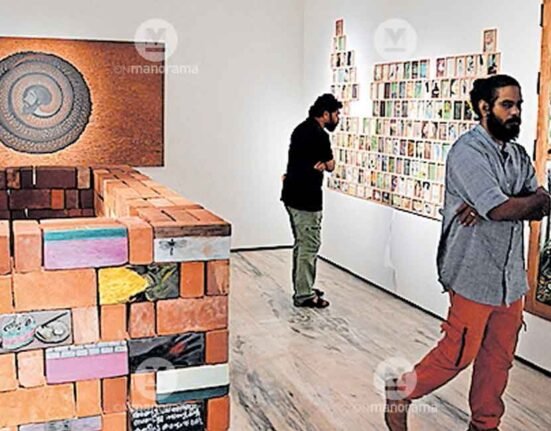

Collecting fine art is as much about beauty and desirability as it about the investment value. Given how strong the art market has been over the past few years, many collectors may not be prepared if the economy slows and the appetite for art cools.

Roy Sebag, a hedge fund analyst turned entrepreneur, has a collection that includes a drawing by Pablo Picasso and works by 17th-century Dutch masters. He said he took an objective view of his collection’s value: looking at both the art’s intrinsic value — how an artist’s work has appreciated — and its social currency.