Financial experts agree. Nikhil Kamath, co-founder, Zerodha, India’s biggest stock brokerage firm, says: “There appears to be an arbitrage (opportunity) available around Indian art as the sector is undervalued vs western peers.” Kamath expects the market to “do well in the coming decade.”

“Typically, every year in March, sales tend to peak and slow down. This year, there has been acceleration. FY23 was the highest selling year for auction houses as far as Indian art is concerned,” says Ashvin Rajagopalan, director, Piramal Art Foundation. “Another indicator of sales is the opening of new galleries in Mumbai. Several have opened their second spaces, while some galleries from other cities are also opening their branches in Mumbai.”

So, who are the new artists in demand?

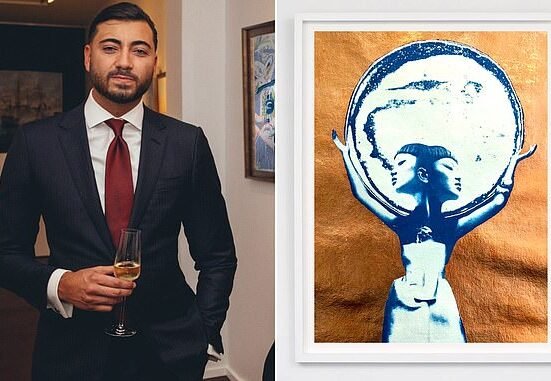

Rajagopalan points to the likes of Raqib Shaw who has been picked up by White Cube London and sells his works in the range of ₹2.5 crore to ₹5 crore; Nikhil Chopra has signed with Gallerie Continua in Paris and his works sell for ₹12 lakh to ₹40 lakh, while Shakuntala works with Kolkata-based Chemould art gallery, and his works are priced between ₹10 lakh and ₹50 lakh; Young Mumbai artist Parag Tandel’s works, ranging from ₹5 lakh to ₹20 lakh, was acquired by the Nita Mukesh Ambani Cultural Centre in Mumbai recently.

Which artists are estimated to see values soar in the coming years? Though experts are divided on the matter, Anand thinks G.R. Santosh, the pioneer of Tantra, Madhvi Parekh, who brought tribal and folk themes to the mainstream, and K.K Hebbar, whose works capture the life of the common man, could be the frontrunners. “There will be price movement in the near term,” says Jerry Rao, a veteran art collector and former head of Citibank India.