“Glad to be partners… Speak soon, I.”

That’s how now disgraced art dealer Inigo Philbrick signed off a June 2013 email to his former friend and investor Andre Sakhai when he sold him a 50 percent share of a Wade Guyton painting, for $350,000.

Sakhai, through his shell company V&A Collections, is now pursuing legal intervention in New York State Supreme Court to protect his interest in the painting, supposedly worth upwards of $1 million.

The problem? The Guyton is yet another artwork caught up in the legal mess Philbrick created by overselling multiple shares of works he did not own, as well as pledging those same works as collateral for multimillion-dollar loans.

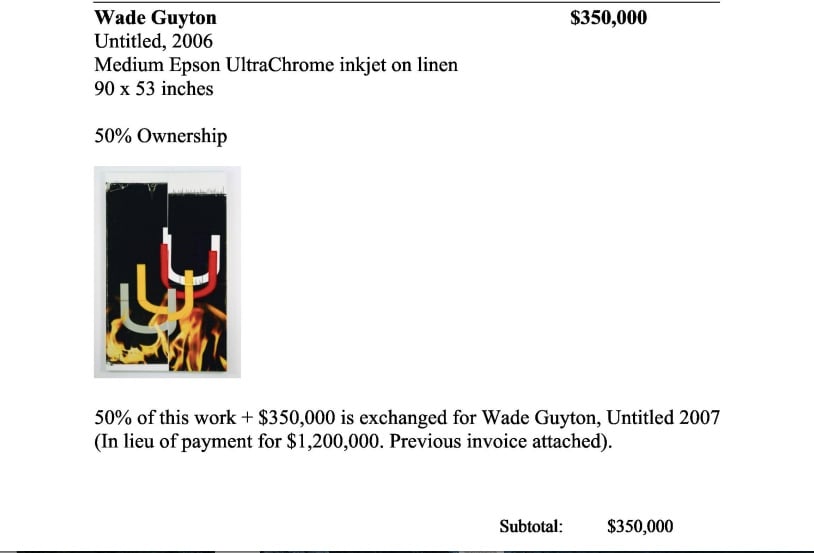

The invoice for a half share of Wade Guyton Untitled (2006). Image courtesy of Supreme Court Records Online.

The Guyton painting, showing the artist’s signature “U” shape hovering above flames, is also one of the works being claimed by Guzzini Properties, another shell company run by billionaire UK-based brothers Simon and David Reuben. The Reubens loaned Philbrick $6 million with several works reportedly pledged as collateral that are now disputed, according to the filing.

The Reubens initially tried to recoup money they had wrapped up in Philbrick’s deals anonymously but Bloomberg News identified them in a story this past December.

“Guzzini acquired artworks from Philbrick totaling $6 million. Any suggestion that this purchase was a loan is argument and without merit,” Guzzini attorney Wendy Lindstrom told Artnet News.

Adding another layer of complication to the case is the fact that at the time Philbrick sold the Guyton share to Sakhai, he was still running Modern Collections, the secondary-market art dealership owned by Jay Jopling, founder and owner of London-based White Cube gallery.

Philbrick got his start in the art world as an intern at White Cube in 2010 before rising through the ranks to co-run Modern Collections and later striking out on his own.

“Modern Collections is part of Jay Jopling’s secondary market business, and he is and always has been the only owner,” a representative said in a statement. “Mr. Philbrick worked for the company and has never had any ownership interest.”

Jopling is one of four entities who have successfully obtained an injunction from a UK High Court that froze Philbrick’s assets until various claims are sorted out.

According to Sakhai’s claim, under the sale with Modern Collections, he agreed to acquire the half interest in the Guyton and receive an additional $350,000 in cash in exchange for a different Guyton work, titled X or the Guyton X in the filing.

Sakhai previously bought Guyton X from Modern Collections in July 2012 for $585,000, according to an invoice. Sakhai and Philbrick agreed that when the “U” painting eventually sold, Sakhai would receive $850,000, Modern Collections would receive $700,000, and they would then evenly split any profit above those amounts.

Then, in 2017, without Sakhai’s “knowledge or consent, and without any compensation,” Philbrick, on behalf of Inigo Philbrick Limited, purported to transfer an interest in the Guyton “U” to Guzzini (aka the Reubens). Sakhai has demanded that Guzzini return the Guyton but says “Guzzini has refused to do so and has declined to recognize the Collection’s ownership interest,” according to the filing.

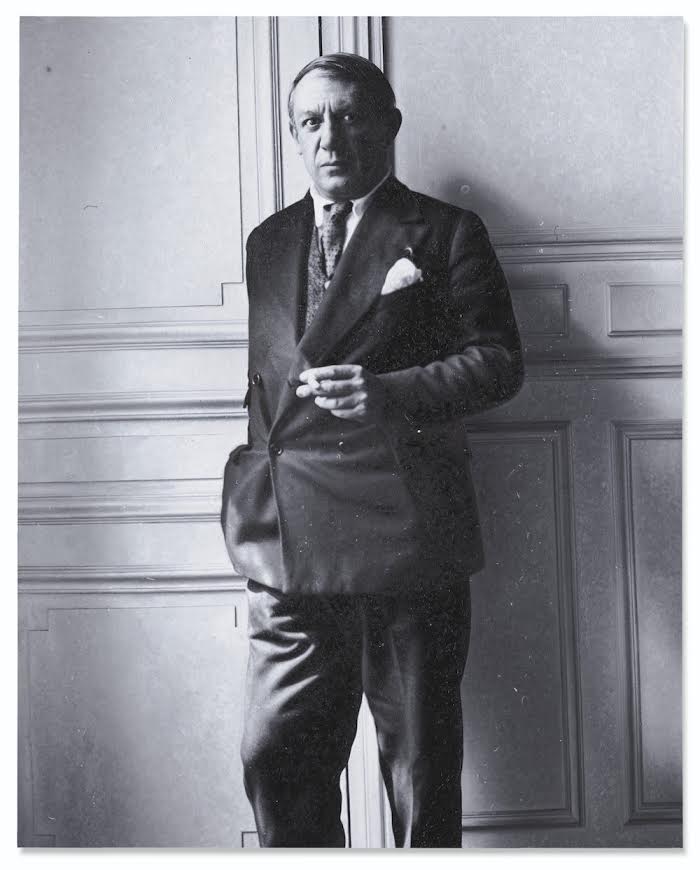

Rudolf Stingel, Untitled (2012). Image courtesy Christie’s.

Along with the Guyton, the Reubens are also claiming title to a Rudolf Stingel painting, Untitled (2012), a photorealist style portrait of Pablo Picasso, which is being chased by at least two other investors who paid Philbrick for shares in it. Christie’s, which is not party to any of the litigation, is holding the work until courts sort out the ownership issue.