Today, you no longer have to be an accredited investor or a billionaire to invest in fine art. The popularity of fractional ownership has boomed in recent years as more and more retail investors are looking to diversify their holdings and break into markets previously reserved for the wealthiest investors.

Alternative investments ranging from NFTs to rare collectibles have seen new companies pop up to offer fractionalized share investment options. ArtTactic reported in 2022 that we could possibly see an avalanche of fractional art ownership platforms coming to the market in the next few years.

What Are Fractional Art Shares?

Fractional shares (of any investment vehicle) are portions of an entire investment that allow investors to purchase stock, real estate, or another asset based on a dollar amount they select rather than the price of a whole share or whole asset.

Fractional ownership is not a new concept broadly speaking — it’s the premise that mutual funds, ETFs, and REITs are all based on.

It’s more expensive and time-consuming for an investor to buy a number of shares in 100 different stocks than it is to purchase a share of a mutual fund or ETF which pools that investment with others and gives the investor a slice of a well-diversified collection of stocks and bonds. Fractional shares of fine art or other real assets function similarly — it’s an easy and accessible way to create a diverse portfolio with a new asset class.

Fine Art as an Asset Class

Art has long been used as a financial asset, with marketplaces and auction houses like Sotheby’s that have existed for more than 275 years. However, it hasn’t been until recently that art’s ability to appreciate was researched and understood, bringing art as a financial asset to the broader investing community.

In 2021, UBS reported that the fine art market had an annual transaction volume of $65.1 billion and a total estimated global value of $1.7 trillion. This makes art comparable in size to other major private markets such as private debt, real estate, and private equity.

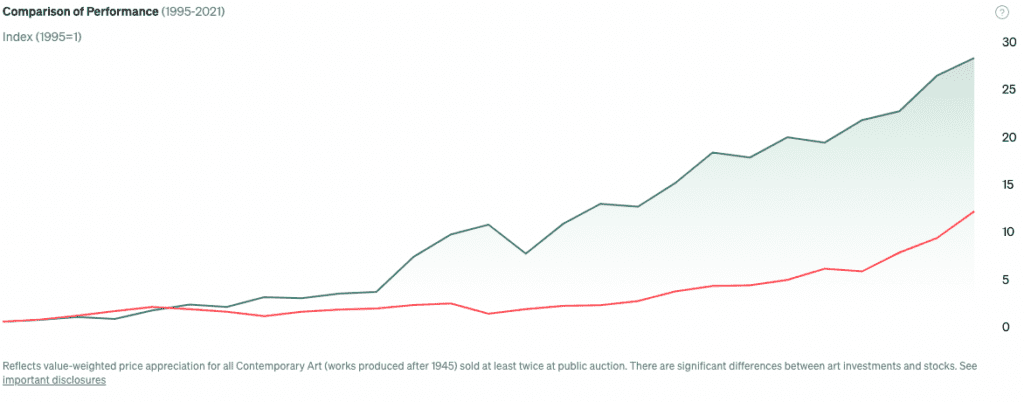

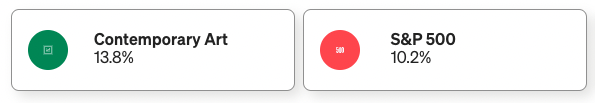

According to Citi’s Global Art Market report, Contemporary Art price appreciation has outpaced the S&P 500 over the last 26 years, offering a 13.8% annual return compared to the S&P 500’s 10.2% annual return.

Benefits of Fractional Art Investing

Despite the size and history of the art market, participation has historically been almost entirely limited to the ultra-wealthy. With recent sale prices of $221.59 million for Pablo Picasso’s Dora Maar (1939) and $195 million for Andy Warhol’s Shot Sage Blue Marilyn, the barriers to entering the art market are high. Securitization and fractionalization of the asset class help to make art accessible to more investors.

Investing in fractional shares also relieves many of the individual burdens that typical art ownership requires such as storage, appraisal, and concerns over counterfeits. Because the investor is working through a firm that offers fractional shares, that firm is responsible for the research required to confirm value and authenticity, as well as responsible for the maintenance, storage, and ultimate sale of the artwork.

These burdens that come with owning art can be costly and time-consuming, placing these responsibilities in the hands of experts frees up time and money for an investor to continue diversifying while still accessing the benefits of investing in fine art. These benefits include low correlation to traditional markets, potential inflation hedge, and aesthetic and cultural value.

Risks of Fractional Art Investing

Because fractionalized art investing is relatively new compared to other investment vehicles, it carries some inherent risk. The fractionalization process is not as developed as the stock market or real estate investments, and it lacks a long-term historical track record.

Beyond its newness on the market, there are additional risks to investing in art broadly that also apply to investing in fractions of that art.

Art is a non-fungible asset, meaning two pieces of art cannot be traded or exchanged for equal value, each piece of art is unique to itself only. Most securities are fungible, meaning that one unit of the asset is interchangeable with another (i.e. one share of Apple stock is equal in value to another share of Apple stock).

Art as an asset is also highly illiquid and can’t easily be sold for cash. While fractional owners do not need to worry about finding a buyer themselves, they do still have to wait out a longer holding period than shorter-term investments in order for the piece of art to appreciate in value.

Masterworks: The First Art Investing Platform

Masterworks was established in 2017 by Scott Lynn, a technology entrepreneur and avid collector of Contemporary Art. Masterworks is the first company to democratize the art world and offer shares of multi-million dollar works of art by some of the world’s most sought-after artists such as Jean-Michel Basquiat, Yayoi Kusama, Andy Warhol and Pablo Picasso.

In the first half of 2022, Masterworks acquired 34 new works with a total purchase value of over $101 million, compared to 25 artworks acquired in the first half of 2021.

As of August 2022, six paintings had been sold including Banksy’s Mona Lisa (2000) for $1.5 million with a reported annualized return of 32% net of fees in 2020 and George Condo’s Staring into Space (2015) for $2.9 million with a reported gross total return of 81.3%, or annualized net return of 31.7%, according to Masterworks SEC filings*. Overall, Masterworks has sold six paintings with an Average Net IRR of 29.03% to investors and an overall Track Record of 15.3%*

How Does Masterworks Securitize Artwork?

Masterworks is the first investment platform to bring investable blue-chip art to a broader, retail stage. A startup in New York, Masterworks uses a special purpose company to securitize individual pieces of art.

First, Masterworks purchases a painting either through private sale or auction, then files an offering of shares with the Securities and Exchange Commission (SEC) as a Delaware-based LLC. Masterworks can then begin to offer shares in the company, which owns the individual painting, to interested members of the platform.

Although there is a minimum investment amount, Class A shares are priced at $20/share. This makes investing in art accessible at a substantially lower price point. Masterworks also offers a secondary market for those interested in more liquidity.

Takeaways

The art market has long been dominated by the ultra-wealthy, but the rise of fractionalized shares has begun to open up the market, allowing more investors to invest in fractions of masterpieces. Understanding how art can be used as a strategic diversifier within a portfolio can allow investors to help improve their own returns and potentially limit downside losses.

You can start investing in blue-chip art with Masterworks today. Masterworks’ industry-leading research and acquisition teams use proprietary data and art market expertise to curate a collection of iconic works of contemporary art.

This material is provided for informational and educational purposes only. It is not intended to be investment advice and should not be relied on to form the basis of an investment decision.

Diversification and asset allocation do not ensure profit or guarantee against loss. There are significant differences between art and other asset classes. Investing involves risk, including loss of all principal. See important Regulation A disclosures at masterworks.io/cd

* Since its inception, Masterworks has sold six paintings from the collection. IRR is net of all fees and expenses and is presented on a deal-weighted basis, which assumes the same investment amount was made in each applicable offering. In certain cases, Masterworks may concede its fees and/or profit-sharing in connection with the sale of a painting for the benefit of the shareholders. Net IRR was calculated assuming all fees and profit sharing to which Masterworks was entitled were charged to the issuer. IRR on sold artwork is not indicative of Masterworks’ overall performance or of future results.

“Track Record” is the internal estimate of the performance of the overall MW portfolio as of 6/30/22 with proportionate weight given to the size of each offering. Track Record is the dollar-weighted aggregate average change in estimated fair market value (FMV) of each issuer offered on an annualized basis, excluding all offerings completed within the last 6 months, after deduction of all fees and pro forma. For artwork yet to be sold, the estimated NAV of the Class A shares sold to the public is based on MW internal appraisals, which are performed on a quarterly basis.

For offerings that were completed between 6 months and 1 year and for which no public auction comparable sale has occurred, the FMV of the artwork is appraised to be equal to the aggregate offering price (the price at which the artwork was sold to investors). If all offerings completed within the last six months were included in the MW Track Record as of 6/30/22, the result would be 14.1%. For purposes of such calculation, the FMV of the artwork in offerings completed during the last 6 months of the performance period is appraised to be equal to the aggregate offering price. Appraisals are performed by MW in conformity with the 2020-21 Uniform Standards of Professional Appraisal Practice using a sales comparison approach. MW may have potential conflicts of interest.