NEW YORK, April 17, 2024 (Newswire.com)

–

There was a time, in which investing in art was widely perceived to be the exclusive province of knowledgeable connoisseurs, high-net-worth individuals, or both. However, that has changed markedly over the past 25 years. In 2023, the global art market came to nearly $70 billion, according to a PBS report. In recent decades, returns have outpaced bonds and blue-chip art has outperformed the S&P 500 by 180%. This has prompted scores of investors of all stripes to seek to capitalize on the sector. An added benefit is the possibility of portfolio diversification, which may be achieved through the investment platform Yieldstreet.

With that in mind, here is a look at understanding art as an investment.

What is the Latest in Art Investing?

The ARTEX Stock Exchange recently started trading, which was big news in the art investment space. The European marketplace enables investors to buy shares of a masterpiece. One recent trading session in which shares opened at EUR 92.20 and closed at EUR 95.00 highlighted the potential of art shares as a key asset class.

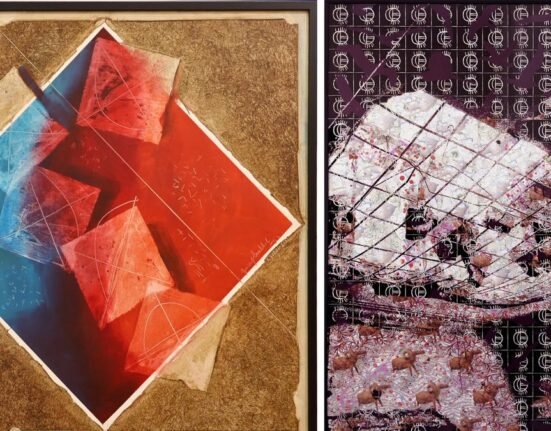

While investors can make purchases through auctions and galleries, fractional ownership may be the wave of the future. For example, Yieldstreet, which offers the broadest selection of alternative asset classes available, offers opportunities for investors to potentially grow their capital through fractional ownership of a diversified pool of works by mid-career and blue-chip artists.

Yieldstreet also offers opportunities to purchase shares in contemporary fine art with its art equity fund. While every investment carries risk, each opportunity is highly vetted. The fund also provides another means of diversifying holdings. Crafting a mixed portfolio of asset types may serve to mitigate overall risk as well as potentially offer protection against inflation.

What Makes Art a Good Investment?

Art is favored as an investment for its relative stability. Unlike stocks, which can often fluctuate with the economy, art values tend to be largely stable. This phenomenon is generally attributed to the asset’s independence from events such as global pandemics. Art values remained steady in 2020, while other assets experienced significant volatility.

A potential drawback to investing in physical artworks is that art isn’t particularly liquid — it isn’t easily converted to cash. However, many investors prefer to use art to diversify portfolios and as part of estate planning. In other words, they invest in art for secondary income, not as their primary asset.

The growing art market has demonstrated ongoing resilience and is expected to remain steady this year, driven in part by share ownership and online platforms. Moreover, technology is increasingly improving transparency in managing and valuing art collections. As an alternative investment, art holds the potential to provide portfolio diversification and may shield against market downturns.

Source: Yieldstreet