Guarantees of 6% return and ‘safe-haven’ asset claims were warning signs, as investors now fight to recover their belongings

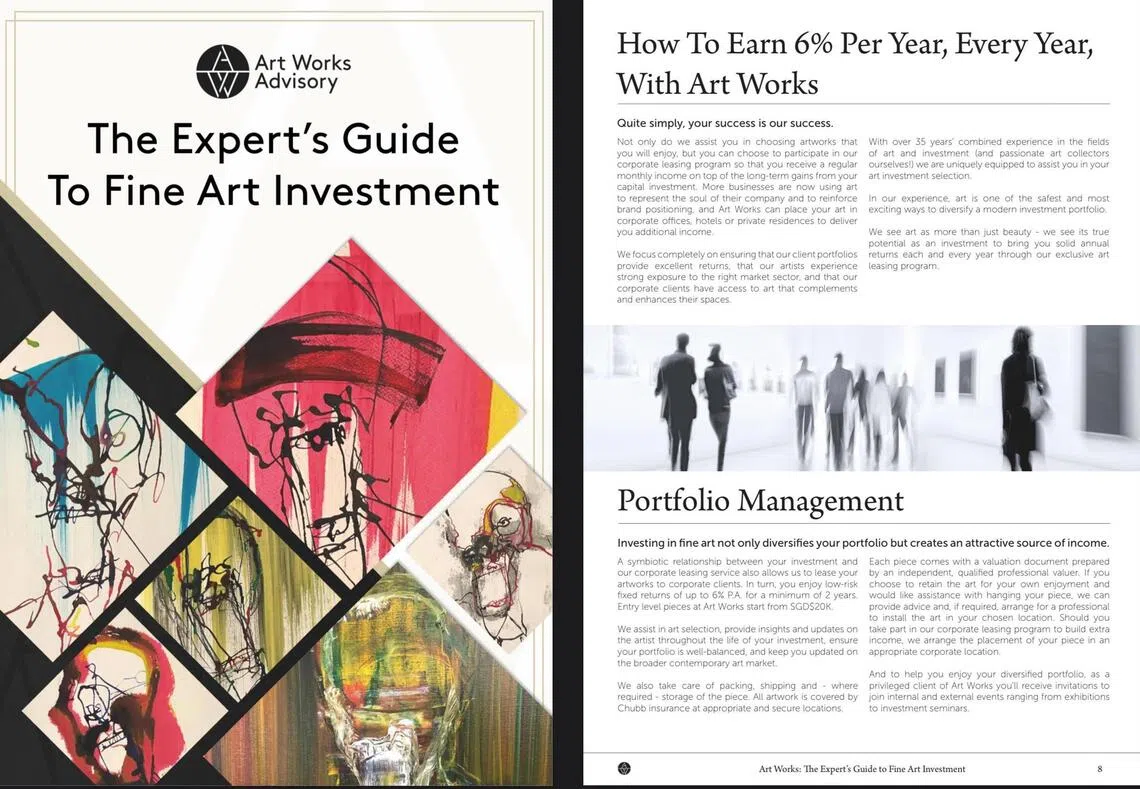

[SINGAPORE] Before its sudden collapse, art-investment firm Art Works wooed clients over wine, fine dining and talk of steady returns – promises that seasoned art observers regarded as overly optimistic even then.

One of them was David (not his real name), a client in his 40s who bought three paintings worth more than S$100,000. Together with two friends who also purchased pieces, he is now “trying to get as much information as possible” while waiting for guidance from the liquidator, Forvis Mazars.

David recalled being impressed by the firm’s polished mix of art and analytics. “They were presenting numbers and analysis. It was more than the usual experience I have of buying art in galleries… There was a sense they knew the market better than most galleries.”

The company, he said, “felt more like a financial investment firm” than a pure art gallery.

Art Works promised clients annual returns of 6 per cent if they agreed to lease their artworks to corporations. David, who also invests in stocks, gold and wine, turned down the offer, uneasy about potential damage to his paintings and possible tax complications.

“The rental income wasn’t (enough) to justify the hassle,” he said. “You’re supposed to pay GST once you bring it out of bond, so I decided to leave the pieces with Art Works and let them appreciate over time.”

That decision now weighs on him heavily. Since being notified of Art Works’ closure on Nov 4, David has been trying to trace his three works – among them a painting by British artist Lincoln Townley.

He believes they remain in a bonded warehouse, though confirmation has yet to come from the liquidator.

“We legally own our pieces… it’s just about returning them to us,” he said. “The confusing part is the information – we’ve yet to receive a clear answer on ownership. We’re prepared to fight a little harder to get what we should get.”

Before the collapse, Art Works’ courting was hard to resist. Clients were invited to formal dinners and exclusive meet-the-artist evenings.

“It would be a cosy setting where you could chat with the artist,” David recalled. “They certainly had more showmanship than the average gallery.”

But he criticised how the closure was handled. “Sure, you go into liquidation – but you should at least manage the clients, make sure the art pieces are with them, paperwork is done, rather than just disappear… There should be more accountability from the directors.”

Art Works was headed by three foreign nationals: Troy Sadler from Australia, and Samuel Hardwick and Chris Hallewell from the UK. Of the three, only Hallewell remains in Singapore to oversee the liquidation process that began on Oct 30.

The social media accounts of the other two have been deactivated. David and his friends were notified of the firm’s closure on Nov 4.

On Monday (Nov 10), Hallewell issued a statement to The Straits Times that employee salaries will be a priority for settlement from liquidation proceeds, and he is cooperating with the police to assist the winding-up process.

The company earlier cited “a confluence of challenging factors” for its closure, including rising operating costs, a slowdown in retail spending as well as geopolitical uncertainty, despite signed term sheets.

“Too good to be true”

One former client, who asked to be identified as Simon, described an earlier iteration of the company under its former name, Art Index International, more than a decade ago.

Art Index persuaded him to purchase an artwork for more than S$22,000 on a lease-out scheme paying above 10 per cent a year for a minimum of two years – an offer he now characterises as “too good to be true”.

He received payments for two years while the piece was rented, he was told, to a bank – but after that, there were no lease renewals.

“When I e-mailed them, they were slow to reply – if they replied at all. Some e-mails even bounced when they changed their name from Art Index to Art Works without telling me,” he said.

“That’s when I started to worry and repeatedly requested that the artwork be returned to me. After some time, they finally delivered it – and I could breathe a sigh of relief.”

Even then, aspects of the operation felt loosely run, he added. “When I asked for a document to state that I own the work… they handed me something that looked like it could have just been done on Word… almost like an internal document.

“When I heard about the liquidation, I can’t say I was surprised.”

Independent curator and art adviser Tan Siuli said the episode reflects how confusing the art market can be to most buyers. “The art world is complex, and has traditionally been premised on exclusivity and insider knowledge,” she said.

“A lot of its jargon is also not widely understood by the general public, and terms may be employed to mislead those without an understanding of their nuances.”

She described “the promise of art as an investment” as one of the biggest red flags collectors should look out for.

“Be wary of anyone who tries to sell you art as an investment. If an art-world insider were promised guaranteed 6 per cent returns, many of us would be putting our money there instead of the stock market.”

Other art experts raised concerns about the way the works were marketed to the public.

Art Works’ brochures, electronic direct mail (EDM) and correspondences with clients contained marketing statements that appear to use promotional language.

For example, there were claims such as “art is a safe-haven asset class” and a “recession-proof investment with enormous growth potential”.

In one brochure advertising the works of artist Danny Minnick, Art Works said: “His abstract expressionist style is often juxtaposed to the works of Jean-Michel Basquiat and reminiscent of the humanity of Keith Haring.”

An experienced gallery manager at Gillman Barracks, who declined to be named, said: “We would never use these kinds of comparisons to describe our artists… It’s not accurate curatorial language – it’s marketing language. For a new art collector, it can be potentially misleading.”

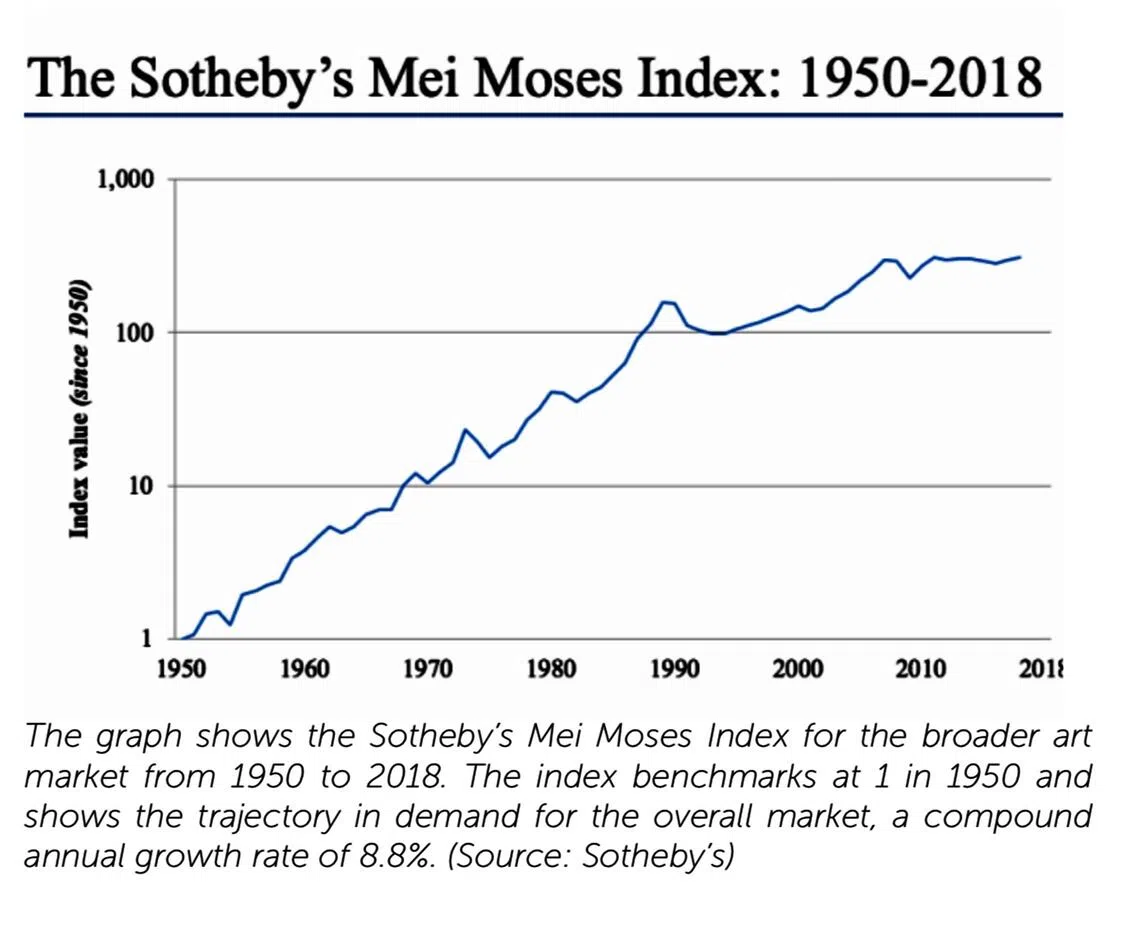

In the same brochure, Art Works displayed a chart, the Sotheby’s Mei Moses Index, to argue that art prices in the “broader art market” consistently rise at “a compound annual growth rate of 8.8 per cent”.

However, according to Sotheby’s website, the index measures only art works that enter auctions.

Chingyi Chua, co-founder of Art Again, a secondary marketplace for pre-owned art, said: “The index is reflective of artwork prices in auctions at the big houses: Christie’s, Sotheby’s and Phillips.

“So (what) percentage of the art market is that? Very small… Private transactions are also the preferred dealing method for collectors, so the index really doesn’t account for a lot of art out there.”

Asked by e-mail to respond to these observations, Hallewell told The Business Times: “I will not be making any further comment at this time as I focus my efforts on supporting the liquidation process with Forvis Mazars.”

Confusing claims

In an earlier EDM promoting the artist Townley, whom it represented, Art Works said that he “has been invited to exhibit at La Biennale di Venezia 2024, making it three appearances in a row – an amazing feat for any artist”.

Records show that Townley exhibited at Palazzo Bembo and Palazzo Mora in independent collateral events that coincided with – but were not formally part of – the Venice Biennale’s officially curated programme.

But the phrasing may give the impression that Townley was part of the prestigious, by invite-only Venice Biennale exhibition.

Tan said that buyers should be cautious of marketing superlatives. “Terms like ‘blue-chip’ or ‘Venice Biennale artist’ can be very broad or loosely used. It is important that would-be collectors exercise due diligence, and understand what these terms really mean.”

Meanwhile, affected artists such as Zhang Fuming said they were awaiting word from the liquidators on the next course of action.

He told BT that he was “more worried about the employees, some of whom are foreigners on work passes, who may now have to return home if they cannot secure new employment”.

Former clients Simon and David said that, apart from the aforementioned issues, the sales team were “pretty good salespeople” and “decent” to deal with, though they faulted the directors for going quiet at the end.

Asked if they will continue collecting art, both said yes. “Art, for me, is a source of comfort and inspiration,” said Simon.

David agreed. “The thing about collecting is that 50 per cent of the time you enjoy the art, and 50 per cent you’re hoping for capital gains.”

Both will approach any talk of “guaranteed gains” from art with caution.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Delivered to your inbox. Free.