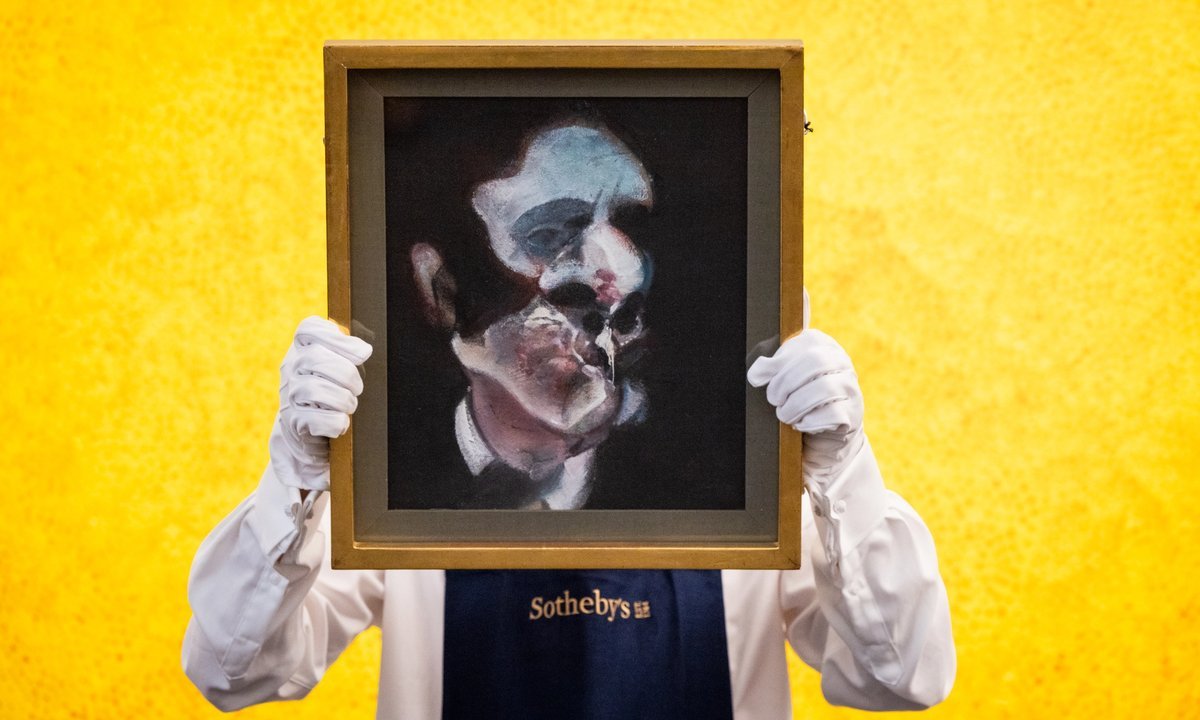

A fuller extent of the financial woes faced by Sotheby’s has been revealed in a Financial Times report, which says that core earnings for the auction house dropped by a massive 88% in the first half of 2024. The news comes amid a wider art market slump marked by a decline in sales, staff cuts and gallery closures.

According to the FT, Sotheby’s told its lenders in a report ahead of a major investment by Abu Dhabi’s sovereign wealth fund, ADQ, of an 88% decrease to its earnings before interest, taxes, depreciation and amortisation (Ebitda), which amounts to $18.1m. When adjusted to disregard costs such as severance pay and lawsuits, this figure still represents a 60% drop.

Sotheby’s did not respond to The Art Newspaper’s request to confirm these figures, nor did it provide a comment to the FT.

In June, Sotheby’s reported more than $1.8bn of net “long-term debt”. It will use part of the $1bn of capital raised by ADQ’s investment—$700m, according to the FT—to “reduce leverage”. The deal with ADQ is expected to be completed by the final quarter of 2024; Sotheby’s total liabilities stand at $4.3bn.

Also revealed by the FT, via the earnings report, is Sotheby’s less dramatic, though still significant, 25% drop in auction sales in the first half of 2024, compared to the same period last year. This falls in line with a 22% year-on-year drop in auction sales reported by its rival Christie’s in July.

These results cover Sotheby’s main auction business but not the earnings of other subsidiaries of its parent company BidFair.