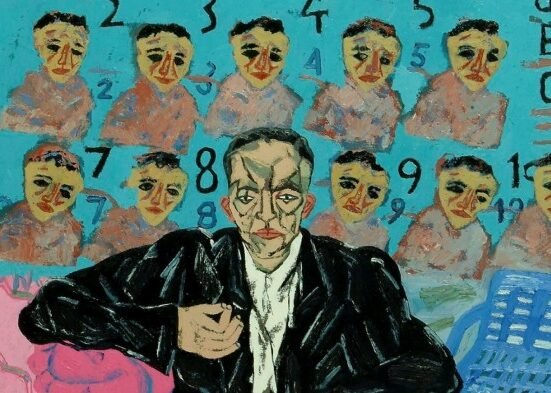

Patrick Drahi, the founder of the Altice telecom empire, is a wily and unsentimental investor—a master at using debt to finance his aspirations. In 2019, he surprised the world by acquiring Sotheby’s for $3.7 billion and taking it private, financing a large portion of the acquisition with $1.88 billion in bonds. But as Altice struggles against its debt load, and upon the revelation that one of his closest partners had been bilking him via a procurement scam, Drahi has needed to shore up his hold on the auction house, which will need to refinance some of its debt in the coming years. Of course, the art market contraction and subsequent hit to Sotheby’s revenue have only made matters more pressing.

On Friday, Sotheby’s announced that Drahi would invest “approximately $1 billion” in additional capital into the auction house alongside A.D.Q., the Abu Dhabi sovereign wealth fund. Most of that approximately $1 billion will come from the Emiratis, but some of it will come from Drahi, so that he can maintain his position as majority shareholder. Over the weekend, it was reported that Drahi sold £1 billion worth of his shares in BT, the British telecom, most likely to cover margin calls. (Altice owns about 25 percent of BT.)